Insurance products

Products

An introduction to our Portcullis products.

Property Investors

Property Insurance is not always as simple as it seems. Sole Traders, Partnerships, Business, or Limited Companies may require cover for a single property or need first class cover for a whole portfolio of differing types of properties.

Markets available for the following types of risks:-

- Landlord Private dwelling

- Commercial Property Investors

- Unoccupied risks a very restrictive market and most insurers will decline to offer terms. Those that do can restrict cover and apply substantial excesses and policy warranties. We can source potentially market leading terms through access into a variety of property insurance markets.

- DSS and Asylum risks

- Listed Buildings

- Private Buy to lets

- Multi mix private and commercial Landlords

- Managing Agents commercials and private

- Pension Fund Investments

Complex, hard to place and distressed risks

- Businesses with Previous Claims Issues

- High-Risk Trades & Hazardous Industries

- Non-Standard Property Risks

- Businesses with Non-Compliant Safety Records

- High-Value and Unusual Assets

- Start-Ups in Emerging or Unregulated Sectors

- Standalone Public and Employers Liability

- Liability for Extreme or Unusual Activities

- Businesses in Financial Difficulty

- Motor Fleets with Adverse Claims History

- Large-Scale Construction & Infrastructure Projects

Haulage & Distribution

Transport and distribution can appear to be a complex issue for any business regardless of type and size. We can provide a number of specially made solutions for a variety of business types, including:

- Long distance Haulage: Goods in transit is a key element to ensure your customers’ goods are covered adequately. You may often need to insure based upon conditions of carriage whether it be RHA Conditions, All Risks, or amended terms. We have extensive expertise is this market and will deliver the exact level of cover to match your business needs.

- Multi drop and next day delivery Couriers

- Freight Forwarders

- Distribution, Logistics & Warehousing: We will deliver a comprehensive package for you which can include Motor Fleet, Liability and a flexible Stockthroughput cover that can cover goods from anywhere to the final destination.

- Shipping & Marine Cargo

- Household Removals

Whether distribution is local or international we have facilities to provide the right solution.

Motor Trade

Portcullis managers realise that this is a specialist field and have extensive expertise to deliver your individual needs. We know that every motor trade business will have a specific set of requirements. We will tailor a policy to fit you exactly via a number of exclusive and bespoke markets.

We are able to assist the following:-

- Main & Second Hand Car Dealers

- MOT Stations

- Service & Repair

- Valeting

- Recovery Operators

- Tyre & Exhaust fitters

- Self Drive Hire

Classic Car Sales and Service: A very special type of cover is required for car restorers. At Portcullis we are particularly aware of the difficulties that can arise over initial valuations of customers’ vehicles compared to the end build value. In order to mitigate against these your manager will pay detailed attention to costs and policies.

Mobile Mechanics: To ensure you and your staff are covered to drive customers’ vehicles on a third party basis we will select the right insurer to accommodate this type of cover. Some companies can exclude this cover or only offer this with an extra cost to you.

Motor Fleet Insurance

- Company Car Fleet Insurance.

- Commercial Vehicle Fleet Insurance

- Haulage Fleet Insurance

- Taxi & Private Hire Fleet Insurance.

- Minibus & Passenger Transport Fleet Insurance.

- Specialist Vehicle Fleet Insurance

- Mixed Fleet Insurance.

- Courier & Delivery Fleet Insurance.

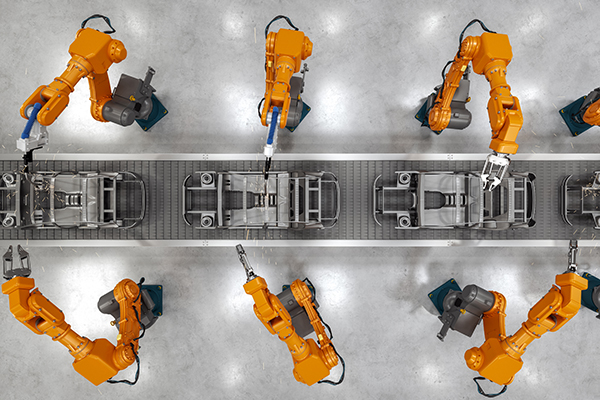

Manufacturing & Suppliers

Protection of your trading premises and business is essential in the event of unforeseen circumstances. Your insurance requirements can be much more than a basic business package and often requires specialist knowledge and expert guidance. Cover will be tailored to your individual requirements supported by major UK Insurers.

Cover will include Employer’s Liability, Public Liability, protection of your contents and stock and potential loss of income from events such as fire, flooding, or storm. Other covers come as standard as well as the potential to add optional extras to cater for your own individual business needs.

Professional Indemnity

- Legal & Professional Services

- Financial & Business Advisors

- Technology & IT Professionals.

- Design & Construction Professions

- Marketing, Media & Creative Industries

- Recruitment & HR Services

- Management & Strategic Consultants

- Healthcare & Allied Professions (Non-Medical Negligence)

- Education & Training Providers

- Specialist Niche Professions

Cyber Insurance

Protecting your business in today’s digital world is just as important as safeguarding your physical premises. With the increasing reliance on technology, cyber threats can pose a serious risk to your operations, finances, and reputation. A standard business policy is often not enough, and that’s where specialist cyber insurance comes in — offering peace of mind with expert knowledge and cover tailored to your needs, backed by major UK insurers.

Our cyber insurance policies can protect you against a wide range of risks, including data breaches, ransomware attacks, phishing scams, and system outages. Cover typically includes the cost of investigating and recovering from an attack, restoring data and systems, managing regulatory requirements, and even handling reputational damage with PR support.

Alongside core protection, policies can also cover financial losses from business interruption caused by a cyber event, third-party liability claims, and legal expenses. Optional extras are available to suit your business requirements, ensuring a flexible solution that grows with you as your digital risks evolve.

Construction & Trades

Construction Insurance for the Regional and National Contractor to the Sole Trader. We have the capability, knowledge and experience to provide individual solutions for a variety of trades within the construction industry. Risks can be complex requiring expert advice relating to JCT Contract Clauses, Performance Bonds, and Contract Works cover through to straightforward Liability Insurance.

We cater for a multitude of trades including:-

- General Builders

- House Builders

- Commercial Contractors potentially working as a main contractor can bring additional requirements if you are working under JCT Contract Conditions for your employer. We have significant knowledge and expertise to ensure you comply and meet with the insurance requirements that may apply to you whilst using these conditions.

- Civil Engineers & Groundwork Contractors

- Plumbing & Heating Engineers

- Electrical Contractors

- Flooring Contractors

- Carpentry Contractors

- Scaffolding Contractors

- Roofing Contractors

Roofing especially is a complex area for liability insurance and a number of insurers will not quote. We have access to a mainstream Composite Insurer who will provide liability facilities for your business. Many more trades catered for.

Pubs & Restaurants

Thorough protection of your trading premises and business is essential in the event of unforeseen circumstances. We have expertise in restaurant, cafe, pub, independent, managed, tenanted, licensed and unlicensed businesses.

Cover will include Employer’s Liability, Public Liability, protection of your contents and stock and potential loss of income from events such as fire, flooding, or storm. Other covers come as standard in addition to having the potential to add optional extras to cater for your own individual business needs.

Shops & Retailers

Protection of your trading premises and business is essential in the event of unforeseen circumstances. Comprehensive shop and retail packages are available for retail chains and individual shop owners. Cover will be suited to your individual requirements supported by major UK Insurers.

Cover will include Employer’s Liability, Public Liability, protection of your contents and stock and potential loss of income from events such as fire, flooding, or storm. Other covers come as standard as well as the potential to add optional extras to cater for your own individual business needs.

Offices & surgeries

Protection of your trading premises and business is essential in the event of unforeseen circumstances. Comprehensive office and surgery packages are available for multi and single sites supported by major UK Insurers.

Cover will include Employer’s Liability, Public Liability, protection of your contents and stock and potential loss of income from events such as fire, flooding, or storm. Other covers come as standard as well as the potential to add optional extras to cater for your own individual business needs.

Hotels and Guest Houses

Protection of your trading premises and business is essential in the event of unforeseen circumstances. Whether independent hotels, guesthouses, or hotel chains, we have access to insurance markets that will be suited to your individual requirements supported by top UK Insurers.

Cover will include Employer’s Liability, Public Liability, protection of your contents and stock and potential loss of income from events such as fire, flooding, or storm. Other covers come as standard as well as the potential to add optional extras to cater for your own individual business needs.

Specialist Motor and High Net worth insurance specialist

Official Business Partner of the Professional Footballers’ Association for six years

- High Net Worth Home Insurance

- Fine Art & Collectibles Insurance

- High Value Motor Insurance

- Yacht & Marine Insurance

- Aviation Insurance

- Worldwide Personal Liability Insurance

- Family Fleet Insurance

- Specialist Travel Insurance

- Bespoke Lifestyle & Cyber Protection

Business insurance can be complex, but it should be simple to buy.

Premium Finance Statement

Portcullis Insurance Brokers Ltd (PIBL) is authorised by the FCA for consumer credit broking. PIBL act for a few lenders and can arrange premium finance facilities to help spread the cost of your insurance premiums. We act as a credit intermediary in introducing you to our panel of independent third-party finance providers. We are not responsible for the credit assessment or terms offered by the finance provider. Your personal information and the bank detail you provide to us will be passed to the lender and they will contact you directly. Credit is subject to status, and they may use a credit reference agency that leaves a record of the search or other information about you to conduct credit and anti-money laundering checks. This record will be visible to third parties. The finance arrangement is a separate contract from the insurance contract, and you must satisfy yourself that the contract is affordable, whether paid by a single payment or spread over 10 to 12 months. The finance provider will have different terms and conditions to that of PIBL and you should therefore ensure you understand and comply with those terms and conditions, especially any fees and charges, and that they are suitable for your financing needs and requirements.